Welcome to “The Ultimate Guide: Top 10 Passive Income Ideas You Can’t Miss in 2024” where we embark on a comprehensive journey into the realm of financial independence. In this guide, we will unravel the most promising and innovative Passive Income Ideas poised to shape the financial landscape in the coming year.

Whether you’re a seasoned investor or someone eager to explore new avenues for wealth creation, these meticulously curated ideas encompass a diverse array of opportunities that transcend traditional income streams. Join us as we delve into the intricacies of these Passive Income Ideas, providing insights, strategies, and a roadmap to help you navigate the evolving landscape of financial freedom.

Table of Contents

- Introduction To Passive Income Ideas Of 2024

- Criteria for Selecting Top Passive Income Ideas

- 01. Dividend Investing: Growing Your Wealth While You Sleep

- 02. Real Estate Crowdfunding: Unlocking Property Profits Passively

- 03. Affiliate Marketing: Monetizing Your Online Presence

- 04. Creating and Selling Online Courses: Sharing Knowledge for Profit

- 05. Peer-to-Peer Lending: Bridging Financial Gaps for Returns

- 06. E-commerce and Dropshipping: Hands-Free Retail Ventures

- 07. Investing in REITs: Real Estate Profits without Property Management

- 08. Blogging and Ad Revenue: Turning Content into Cash

- 09. Automated Stock Trading: Letting Algorithms Work for You

- 10. Royalties from Intellectual Property: Passive Rewards for Creators

- Conclusion: Crafting Your Passive Income Portfolio for 2024 and Beyond

Introduction To Passive Income Ideas Of 2024

Passive income, a term buzzing in financial circles, represents a transformative approach to wealth-building that doesn’t necessitate constant, active effort. In essence, it’s money earned with minimal involvement after the initial setup.

This guide dives into the world of passive income ideas, uncovering opportunities that can redefine your financial landscape in 2024. Passive income isn’t a magic formula for overnight success; instead, it’s a strategic, long-term approach that allows you to generate revenue streams while maintaining flexibility and autonomy.

As we explore various avenues, from dividend investing and real estate crowdfunding to affiliate marketing and creating online courses, the goal is to empower you with the knowledge to make informed decisions and construct a diversified portfolio of passive income Ideas. Buckle up for a journey into the realm of financial autonomy and discover the top 10 passive income ideas you can’t afford to overlook in the coming year.

Criteria for Selecting Top Passive Income Ideas

Embarking on the journey of building a Passive Income Ideas requires a keen understanding of the criteria that distinguish lucrative opportunities from fleeting trends.

The world of passive income is vast and varied, encompassing everything from traditional investments to digital ventures.

As you explore different avenues, it’s crucial to establish a set of criteria that align with your financial goals, risk tolerance, and personal preferences.

-

Sustainability and Longevity: The first and foremost criterion is the sustainability and longevity of the passive income ideas. Seek opportunities that have the potential to generate income consistently over the long term. This could involve analyzing market trends, assessing the demand for a particular product or service, and considering the resilience of the chosen income stream to economic fluctuations.

-

Initial Investment and Risk Tolerance: Passive Income Ideas often require an initial investment, whether it’s financial capital, time, or expertise. Evaluate your risk tolerance and financial capacity before diving in. Some ventures might demand a higher upfront investment but promise substantial returns, while others may be low-risk but yield more modest profits.

-

Scalability and Growth Potential: Look for passive income ideas that can scale with your efforts and offer room for growth. Whether it’s through reinvesting earnings or expanding your reach, scalability ensures that your income stream isn’t capped and has the potential to evolve as your financial goals change.

-

Diversification Across Multiple Streams: Diversification is a fundamental principle of sound financial planning. Instead of relying on a single passive income ideas, consider building a diversified portfolio. This could involve exploring opportunities in various sectors, industries, or investment vehicles, reducing the risk associated with relying on a single income stream.

-

Level of Involvement and Autonomy: Assess your desired level of involvement in managing your passive income ideas. Some ideas require active participation, especially in the initial stages, while others offer a more hands-off approach. Consider your lifestyle, time commitments, and whether you prefer a more autonomous or managed approach to your investments.

-

Market Demand and Trends: Stay attuned to market demand and emerging trends. Identifying opportunities aligned with current and future trends enhances the likelihood of success. This requires ongoing research and a willingness to adapt your passive income ideas in response to evolving market dynamics.

-

Tax Implications: Understand the tax implications associated with each passive income idea. Tax efficiency can significantly impact your overall returns. Some investments may offer tax advantages, while others might have higher tax liabilities. Consult with financial experts or tax professionals to optimize your passive income strategy from a tax perspective.

-

Personal Interest and Passion: While financial considerations are paramount, don’t overlook the importance of personal interest and passion. Engaging in ventures you find interesting or align with your passions can make the journey more fulfilling and sustainable over the long term.

By applying these criteria to your evaluation process, you’ll be better equipped to identify and capitalize on the top passive income ideas that align with your unique financial objectives and aspirations. Remember, the key to successful passive income lies in a thoughtful and strategic approach that aligns with your individual circumstances.

01. Dividend Investing: Growing Your Wealth While You Sleep

Dividend investing stands out as a prime example among passive income ideas, offering a time-tested strategy to grow wealth steadily over the long term. This investment approach involves purchasing shares in dividend-paying companies, allowing investors to receive a portion of the company’s profits regularly.

The allure of dividend investing lies in its dual benefit: not only do investors potentially benefit from the stock’s appreciation over time, but they also receive a steady stream of income, often in the form of quarterly dividends.

One of the key advantages of dividend investing is its passive nature. Once you’ve carefully selected dividend-paying stocks, you can essentially set your investments on autopilot, letting your wealth accumulate while you focus on other aspects of your life.

This makes it an ideal option for individuals seeking to augment their income without the day-to-day involvement demanded by active trading or other business ventures.

How Dividend Investing Works?

When you invest in dividend-paying stocks, you become a shareholder in the company. These companies, usually established and financially stable, share a portion of their profits with shareholders. Dividends are typically paid out on a regular schedule, providing investors with a predictable income stream. Reinvesting these dividends by purchasing additional shares can compound your returns over time, accelerating the growth of your investment portfolio.

Benefits of Dividend Investing

-

Steady Income: Dividend stocks offer a reliable income stream, making them an attractive option for investors seeking consistent cash flow. This can be particularly beneficial for retirees or those looking to supplement their regular income.

-

Potential for Capital Appreciation: Beyond dividends, dividend-paying stocks have the potential for capital appreciation. As the company grows and prospers, the value of your shares may increase, contributing to overall portfolio growth.

-

Historical Performance: Historical data reveals the resilience of dividend stocks, often outperforming non-dividend-paying stocks over the long term. The stability and financial health of dividend-paying companies contribute to this track record.

-

Inflation Hedge: Dividends have the potential to outpace inflation, providing a hedge against the eroding impact of rising living costs. Companies that consistently raise their dividend payouts can offer a buffer against the diminishing purchasing power of money.

External References:

- The Power of Dividend Growth Investing – Investopedia

- Dividend Investing: A Comprehensive Beginner’s Guide – Forbes

- Dividend Stocks: How They Work and Basic Strategies – The Balance

In conclusion, dividend investing offers a compelling avenue for those seeking passive income ideas. By strategically selecting dividend-paying stocks and embracing a long-term perspective, investors can potentially build wealth steadily while enjoying the benefits of both income and capital appreciation. As with any investment strategy, thorough research and a diversified approach are key to maximizing the advantages of dividend investing.

02. Real Estate Crowdfunding: Unlocking Property Profits Passively

Real estate crowdfunding has emerged as a revolutionary avenue for passive income, democratizing access to lucrative property investments. Traditionally, real estate has been an exclusive realm, demanding significant capital and expertise. However, the rise of crowdfunding platforms has transformed this landscape, allowing individuals to pool their resources and invest in real estate projects collectively. This passive income idea leverages the power of the crowd, enabling investors to reap the rewards of real estate without the burdens of property management or large upfront costs.

How Real Estate Crowdfunding Works?

Real estate crowdfunding platforms connect investors with a variety of property opportunities, ranging from residential developments to commercial spaces. Investors can browse through projects, often with detailed descriptions and financial projections, and choose to invest a specific amount. As multiple investors contribute, they collectively fund the project, and in return, they receive a share of the profits proportional to their investment.

Benefits of Real Estate Crowdfunding

-

Diversification: Real estate crowdfunding allows investors to diversify their portfolios across various properties and locations. This mitigates risk by reducing the dependence on the performance of a single asset.

-

Accessibility: Crowdfunding platforms make real estate accessible to a broader audience. Investors can participate in high-quality real estate projects with relatively small investment amounts, breaking down the traditional barriers to entry.

-

Passive Involvement: Unlike traditional property ownership, real estate crowdfunding lets investors enjoy the benefits of property appreciation and rental income without the active responsibilities of management. The crowdfunding platform handles property administration, reducing the time and effort required from investors.

-

Reduced Capital Requirements: Real estate crowdfunding allows investors to enjoy the potential returns of real estate without the need for significant upfront capital. This democratization of real estate investments is particularly appealing to those who may not have the financial capacity for full property ownership.

Considerations for Real Estate Crowdfunding:

-

Due Diligence: While crowdfunding platforms provide detailed information, investors must conduct thorough due diligence. This includes assessing the track record of the platform, understanding the specifics of the project, and evaluating the potential risks.

-

Project Selection: Investors should diversify their investments across different types of real estate projects and geographic locations. This diversification strategy helps spread risk and enhances the potential for consistent returns.

-

Platform Reputation: Choosing a reputable crowdfunding platform is crucial. Investigate the platform’s history, reviews, and success stories. A reliable platform provides transparency, clear communication, and effective management of investment projects.

External References:

- Real Estate Crowdfunding: A Guide for Investors – Investopedia

- The Pros and Cons of Real Estate Crowdfunding – Forbes

- How to Invest in Real Estate Crowdfunding – The Motley Fool

In essence, real estate crowdfunding presents a compelling opportunity for passive income, offering investors the chance to partake in the profits of real estate ventures without the complexities associated with property ownership. As with any investment, a careful approach, due diligence, and a diversified strategy are essential to maximize the benefits and navigate potential risks in the dynamic world of real estate crowdfunding.

03. Affiliate Marketing: Monetizing Your Online Presence

Affiliate marketing stands as a formidable pillar among the top passive income ideas, offering individuals the opportunity to turn their online presence into a revenue-generating asset. In essence, affiliate marketing is a performance-based strategy where individuals, known as affiliates, promote products or services and earn a commission for each sale or action generated through their unique affiliate link. This dynamic and scalable income stream has gained immense popularity, particularly among those with a robust online presence, as it aligns seamlessly with the principles of passive income.

Navigating the Affiliate Marketing Landscape:

Affiliate marketing operates on a simple premise – affiliates promote products or services, and when a sale occurs through their referral, they receive a commission. The key lies in strategic promotion, effective content creation, and selecting products that resonate with the affiliate’s audience.

How Affiliate Marketing Works?

-

Affiliate Sign-Up: Affiliates typically sign up for affiliate programs offered by companies or affiliate networks. These programs provide a unique affiliate ID and tracking links.

-

Promotion and Content Creation: Affiliates create content, often in the form of blog posts, reviews, videos, or social media posts, where they incorporate their affiliate links naturally. The goal is to authentically endorse the product or service.

-

Audience Engagement: Building trust with the audience is crucial. Affiliates engage with their audience, addressing concerns, providing valuable information, and positioning themselves as trustworthy sources.

-

Conversion Tracking: Affiliate links contain tracking mechanisms that record when a user clicks on the link and makes a purchase. This data is vital for calculating commissions.

-

Commission Payouts: Affiliates receive commissions based on predefined terms – these can be a percentage of the sale, a fixed amount, or other agreed-upon metrics.

Benefits of Affiliate Marketing:

-

Low Entry Barrier: Getting started with affiliate marketing is relatively simple. Affiliates can join programs for free and start promoting products without the need for significant upfront investment.

-

Flexibility and Scalability: Affiliate marketing allows individuals to work at their own pace and scale their efforts. Whether someone is a part-time blogger or a full-time content creator, the flexibility of affiliate marketing caters to various lifestyles.

-

No Product Creation or Customer Support: Affiliates don’t need to create products or handle customer support. Their primary focus is on promoting products, leaving the logistical aspects to the product creators or companies.

-

Diverse Income Streams: Affiliates can diversify their income by promoting products from different niches and industries. This diversification helps mitigate risks associated with reliance on a single product or niche.

Considerations for Successful Affiliate Marketing:

-

Authenticity and Relevance: Successful affiliates focus on products or services that align with their niche and are genuinely beneficial to their audience. Authenticity builds trust, fostering a loyal following.

-

Compliance and Transparency: Adhering to ethical practices and complying with regulations is paramount. Affiliates must disclose their affiliate relationships transparently to maintain credibility.

-

Continuous Learning: The affiliate marketing landscape evolves, and successful affiliates stay informed about industry trends, marketing strategies, and changes in algorithms to adapt and optimize their approaches.

External References:

-

Amazing Psychology of Affiliate Marketing – DigitalSMN

- The Beginner’s Guide to Affiliate Marketing – Oberlo

- Affiliate Marketing for Beginners: What You Need to Know – Entrepreneur

- Affiliate Marketing Made Simple: A Step-by-Step Guide – Neil Patel

In conclusion, affiliate marketing stands as an enticing avenue for those seeking passive income through online channels. By effectively leveraging their online presence and strategically promoting products, affiliates can create a sustainable income stream that grows with their audience. The versatility, low entry barrier, and potential for substantial earnings make affiliate marketing a cornerstone in the realm of passive income ideas.

Read Our Product Review Here

04. Creating and Selling Online Courses: Sharing Knowledge for Profit

In the digital age, creating and selling online courses has emerged as a powerful and accessible avenue for individuals to transform their expertise into a passive income stream.

This innovative passive income idea not only allows creators to share their knowledge with a global audience but also provides an opportunity to generate revenue continuously. The process involves developing educational content, packaging it into structured courses, and making it available for interested learners.

As the demand for online education continues to rise, driven by the convenience and flexibility it offers, venturing into the realm of online course creation becomes an enticing prospect for those seeking passive income.

The Dynamics of Online Course Creation:

-

Identifying Your Expertise: Successful online courses often stem from the creator’s expertise in a specific subject. Whether it’s professional skills, hobby-related knowledge, or academic proficiency, identifying one’s forte is the initial step.

-

Understanding Your Target Audience: Tailoring courses to a specific audience ensures relevance and resonance. Understanding the needs, preferences, and knowledge level of your target audience is crucial for crafting engaging and valuable content.

-

Content Creation and Structuring: Creating high-quality content is the heart of online course development. This involves organizing information logically, incorporating multimedia elements, and employing instructional design principles for effective learning.

-

Choosing a Platform: Numerous online platforms facilitate course hosting, providing creators with the infrastructure to showcase, sell, and deliver their courses. Platforms like Udemy, Teachable, and Coursera offer varying features and reach.

-

Marketing Your Course: Effective marketing is essential for attracting learners to your course. This involves utilizing social media, content marketing, email campaigns, and other strategies to reach your target audience.

-

Engaging with Learners: Interactivity enhances the learning experience. Engaging with learners through discussions, forums, and Q&A sessions fosters a sense of community and adds value to the course.

Advantages of Creating and Selling Online Courses:

-

Flexibility and Convenience: Creators can develop courses at their own pace, and learners can access content anytime, anywhere, providing unparalleled flexibility for both parties.

-

Scalability: Once created, online courses can be sold to an unlimited number of learners without significant additional effort, making scalability a defining feature of this passive income idea.

-

Monetizing Expertise: Sharing specialized knowledge allows creators to monetize their expertise, turning what they know into a sustainable income stream.

-

Global Reach: Online courses have a global audience. Creators can reach learners from diverse backgrounds, expanding their influence beyond geographical constraints.

Considerations for Successful Online Course Creation:

-

Quality Content Creation: The cornerstone of a successful online course is the quality of its content. Clear explanations, engaging visuals, and interactive elements contribute to an effective learning experience.

-

Responsive Course Design: Ensuring that the course is accessible on various devices enhances the learning experience for a broader audience.

-

Effective Marketing Strategies: Implementing targeted marketing strategies is vital for reaching the intended audience. This includes leveraging social media, search engine optimization (SEO), and partnerships.

-

Continuous Improvement: Regularly updating and enhancing course content based on feedback and industry changes is crucial for maintaining relevance and learner satisfaction.

External References:

- Launch Your Digital Product In Just 8 Steps – DigitalSMN

- How to Create and Sell an Online Course: The Ultimate Guide – Shopify

- The Complete Guide to Creating and Selling Online Courses – Forbes

- How to Create an Online Course in 2024 – LearnWorlds

In conclusion, creating and selling online courses represents a dynamic and profitable passive income idea, allowing individuals to share their expertise while generating revenue continuously. As the demand for online education continues to soar, those with valuable knowledge to impart have an unprecedented opportunity to contribute to the global learning landscape and build a sustainable income stream simultaneously.

Read Our Product Review Here

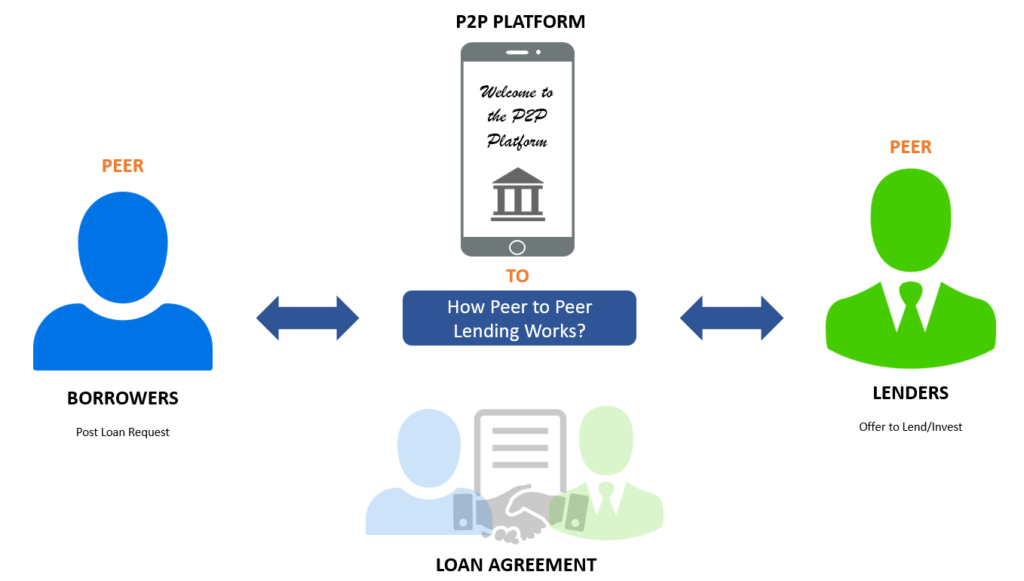

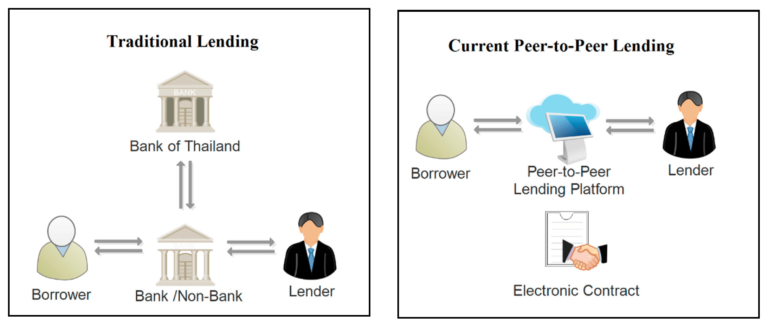

05. Peer-to-Peer Lending: Bridging Financial Gaps for Returns

Peer-to-peer lending, often abbreviated as P2P lending, stands as a modern and innovative form of investment that empowers individuals to participate in the lending process, connecting borrowers directly with lenders through online platforms.

This passive income idea provides an avenue for investors to earn returns by funding loans to individuals or small businesses. As a result, it serves as a bridge, connecting those in need of funds with individuals looking to grow their wealth through lending.

The rise of P2P lending platforms has disrupted traditional financial systems, offering both borrowers and lenders increased efficiency, accessibility, and the potential for attractive returns.

The Mechanics of Peer-to-Peer Lending:

-

Platform Selection: Investors begin by choosing a P2P lending platform that aligns with their risk tolerance, investment goals, and preferences. Platforms like Prosper, LendingClub, and Funding Circle facilitate these transactions.

-

Loan Selection: Investors then select individual loans or portions of loans to fund. Each loan typically represents a fractional share, allowing investors to diversify their investment across multiple borrowers.

-

Risk Assessment: Evaluating the risk associated with each borrower is crucial. P2P lending platforms often provide credit scores, borrower profiles, and other relevant information to assist investors in making informed decisions.

-

Loan Funding: Once a loan is selected, investors contribute funds to fulfill the loan amount. As borrowers make monthly payments, investors receive a portion of those payments, including both principal and interest.

-

Returns and Risks: Investors earn returns based on the interest paid by borrowers. While P2P lending can yield attractive returns, it is not without risks. Factors like borrower defaults and economic downturns can impact investment returns.

Advantages of Peer-to-Peer Lending:

-

Diversification: Investors can spread their investment across numerous loans, reducing the impact of defaults on their overall portfolio.

-

Higher Returns: P2P lending can offer higher returns compared to traditional savings accounts or certain investment options.

-

Accessible Investment: P2P lending platforms provide a straightforward and accessible way for individuals to enter the lending market with relatively low investment amounts.

-

Social Impact: Investors have the opportunity to support individuals and small businesses by providing them with access to much-needed capital.

Challenges and Considerations:

-

Default Risk: The primary risk associated with P2P lending is the potential for borrowers to default on their loans. Thoroughly assessing borrower profiles and diversifying investments can help mitigate this risk.

-

Market and Economic Factors: Economic downturns or shifts in market conditions can impact borrower repayment capabilities and, consequently, investor returns.

-

Regulatory Environment: The regulatory environment for P2P lending varies by jurisdiction. Investors should stay informed about any regulatory changes that may affect their investments.

External References:

- Understanding Peer-to-Peer Lending – Investopedia

- The Rise of Peer-to-Peer Lending – Forbes

- P2P Lending: What You Need to Know – NerdWallet

In conclusion, peer-to-peer lending presents a compelling passive income idea that empowers individuals to participate in the lending market, facilitating a direct connection between lenders and borrowers. By leveraging online platforms, investors can diversify their portfolios, potentially earn attractive returns, and contribute to the financial well-being of borrowers. However, like any investment strategy, it comes with risks that necessitate careful consideration and due diligence.

06. E-commerce and Dropshipping: Hands-Free Retail Ventures

In the landscape of passive income ideas, e-commerce and dropshipping have emerged as transformative models, allowing entrepreneurs to establish online retail ventures with minimal upfront investment and operational complexities.

This innovative approach to retailing has reshaped traditional business paradigms, enabling individuals to create online stores, curate product offerings, and manage sales—all without the need to handle physical inventory or fulfillment.

As the e-commerce ecosystem continues to thrive, the dropshipping model, in particular, stands out as a hands-free and scalable way for aspiring business owners to tap into the vast world of online retail.

Understanding E-commerce and Dropshipping:

-

E-commerce Basics: E-commerce refers to the buying and selling of goods and services over the Internet. Entrepreneurs can establish digital storefronts, reaching a global audience without the constraints of brick-and-mortar locations.

-

Dropshipping Dynamics: Dropshipping is a business model within e-commerce where store owners don’t keep the products they sell in stock. Instead, when a store sells a product, it purchases the item from a third party and has it shipped directly to the customer. This eliminates the need for inventory storage and fulfillment logistics.

Key Elements of E-commerce and Dropshipping:

-

Product Selection: Entrepreneurs can curate product catalogs based on market trends, customer preferences, and niche markets. This flexibility allows for testing different product lines without the financial commitment of stocking inventory.

-

Online Store Setup: Creating an e-commerce store has become more accessible than ever with platforms like Shopify, WooCommerce, and BigCommerce. These platforms provide user-friendly interfaces for designing, launching, and managing online stores.

-

Supplier Relationships: In dropshipping, establishing reliable relationships with suppliers is crucial. Suppliers handle inventory and fulfillment, allowing store owners to focus on marketing and customer engagement.

-

Marketing and Sales: Effective marketing strategies, including social media marketing, search engine optimization (SEO), and paid advertising, play a vital role in attracting customers to the online store. Engaging product descriptions, high-quality images, and competitive pricing contribute to successful sales.

Advantages of E-commerce and Dropshipping:

-

Low Entry Barriers: E-commerce and dropshipping require minimal upfront investment compared to traditional retail models. This lowers barriers to entry, making it accessible for entrepreneurs with limited capital.

-

Scalability: As sales grow, entrepreneurs can scale their operations seamlessly without the burden of managing physical inventory. Dropshipping allows for expanding product offerings without the complexities of warehousing.

-

Location Independence: E-commerce businesses, particularly those employing dropshipping, offer entrepreneurs the flexibility to operate from anywhere with an internet connection. This location independence is a key factor in the appeal of this passive income idea.

-

Risk Mitigation: The dropshipping model mitigates the risks associated with holding excess inventory. Store owners only purchase products when they make a sale, reducing the financial risk.

Challenges and Considerations:

-

Supplier Reliability: Relying on third-party suppliers means store owners must carefully vet suppliers to ensure product quality and timely fulfillment.

-

Competition: The popularity of e-commerce has led to increased competition. Effective marketing and differentiation strategies are essential for standing out in a crowded market.

-

Customer Service: While dropshipping streamlines many operational aspects, providing excellent customer service remains crucial. Responsiveness to customer inquiries and managing returns contribute to long-term success.

External References:

- The Ultimate DropShipping Mastery – DigitalSMN

- What is Dropshipping? – Shopify

- E-commerce Trends – Oberlo

- How to Start a Dropshipping Business – Entrepreneur

In conclusion, e-commerce and dropshipping offer a dynamic and hands-free approach to venturing into the world of online retail. Entrepreneurs can leverage the power of digital platforms, tap into global markets, and build scalable businesses with minimal operational complexities. However, success in this space requires strategic product selection, effective marketing, and a commitment to customer satisfaction. As the e-commerce landscape continues to evolve, those embracing innovative models like dropshipping stand poised to unlock new dimensions of passive income potential.

Read Our Product Review Here

07. Investing in REITs: Real Estate Profits without Property Management

Investing in Real Estate Investment Trusts (REITs) stands as a cornerstone among passive income ideas, providing individuals with a unique avenue to access real estate profits without the burdens of property ownership and management.

This financial instrument, often hailed for its accessibility and simplicity, allows investors to participate in the lucrative real estate market without the need for substantial capital, property maintenance responsibilities, or the intricacies associated with being a landlord.

As an innovative financial tool, REITs democratize real estate investment, offering a hands-off approach to building wealth through income-generating properties.

Understanding REITs:

-

Definition and Structure: REITs are investment vehicles that own, operate, or finance income-producing real estate across various sectors, including residential, commercial, and industrial properties. They are designed to provide investors with a share of the income produced through real estate assets.

-

Types of REITs: REITs are categorized into equity REITs, mortgage REITs, and hybrid REITs. Equity REITs own and manage properties, mortgage REITs invest in real estate debt, and hybrid REITs combine elements of both.

Key Elements of Investing in REITs:

-

Accessibility: Unlike traditional real estate investment, which often requires substantial capital for property acquisition, REITs are traded on major stock exchanges. This accessibility allows investors to buy and sell shares with ease.

-

Diversification: REITs offer a diversified investment portfolio, as they typically hold a variety of properties. This diversification helps mitigate risk compared to investing in a single property.

-

Passive Income: One of the primary attractions of REITs is the generation of passive income. They are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends.

-

Liquidity: REIT shares can be bought or sold on the stock market, providing investors with liquidity that is not readily available in traditional real estate transactions.

Advantages of Investing in REITs:

-

Low Entry Barriers: Individuals with modest capital can invest in REITs, allowing them to participate in real estate markets that might otherwise be out of reach.

-

Professional Management: REITs are managed by experienced professionals who handle property management, tenant relations, and other operational aspects. Investors benefit from the expertise without being directly involved in day-to-day management.

-

Dividend Income: Regular dividend payments from REITs offer a consistent income stream, making them an attractive option for income-focused investors.

-

Portfolio Diversification: Including REITs in an investment portfolio provides diversification benefits, reducing exposure to risks associated with individual properties.

Challenges and Considerations:

-

Market Sensitivity: REIT values can be influenced by broader economic conditions and interest rate fluctuations, impacting share prices.

-

Tax Implications: While REIT dividends offer tax advantages, investors should be aware of tax implications, including potential taxes on capital gains.

-

Research and Due Diligence: Investors should conduct thorough research on the specific REITs they consider, examining their portfolios, management teams, and historical performance.

External References:

- What is a REIT? – Investopedia

- Types of REITs – Nareit

- Benefits and Risks of REITs – U.S. Securities and Exchange Commission

In conclusion, investing in REITs represents a compelling strategy for individuals seeking passive income from real estate without the complexities of property management. The accessibility, liquidity, and income-generating potential of REITs make them a valuable addition to diversified investment portfolios. While there are risks and considerations, the benefits of regular dividends, professional management, and portfolio diversification position REITs as a noteworthy avenue for those aspiring to build wealth through real estate without the hands-on responsibilities of property ownership.

08. Blogging and Ad Revenue: Turning Content into Cash

Blogging, once considered a personal online journaling hobby, has evolved into a powerful platform for generating passive income through ad revenue. In the realm of passive income ideas, blogging stands out as a versatile and accessible option for individuals looking to turn their passion for writing or a niche expertise into a lucrative venture.

This strategy involves creating and regularly updating a blog with valuable content, attracting a dedicated readership, and monetizing the platform through advertising partnerships. As the digital landscape continues to expand, the potential for bloggers to earn a passive income through ad revenue remains robust, making it an appealing avenue for those with a penchant for storytelling or subject matter expertise.

Key Elements of Blogging for Ad Revenue:

-

Content Creation: Successful blogging begins with creating high-quality, engaging content. Bloggers must identify their target audience, address their needs, and consistently produce valuable content that keeps readers coming back.

-

Building a Niche: Specializing in a particular niche allows bloggers to establish authority and attract a dedicated audience interested in specific topics. This focused approach enhances the effectiveness of advertising partnerships.

Monetizing Strategies:

-

Display Advertising: Bloggers can incorporate display ads on their websites, earning revenue based on the number of impressions or clicks. Google AdSense is a popular choice, automatically placing relevant ads on the blog.

-

Affiliate Marketing: By partnering with companies and promoting their products or services, bloggers earn a commission for each sale or action generated through their affiliate links. This strategy aligns with the blog’s content and audience interests.

-

Sponsored Content: Brands may pay bloggers to create content featuring their products or services. This sponsored content seamlessly integrates with the blog’s style, providing value to both the audience and the sponsoring brand.

Advantages of Blogging for Ad Revenue:

-

Flexibility and Creativity: Bloggers have the freedom to choose their content topics and writing style, allowing for creative expression and exploration of personal interests.

-

Global Reach: The internet provides a global platform, enabling bloggers to reach audiences worldwide. This expansive reach enhances the potential for ad revenue generation.

-

Low Entry Barriers: Starting a blog requires minimal investment, making it accessible to individuals with various backgrounds and financial resources.

-

Scalability: As a blogger’s audience grows, so does the potential for ad revenue. Scaling a blog involves consistently producing quality content and strategically expanding the reach.

Challenges and Considerations:

-

Initial Investment of Time: Building a successful blog takes time, and monetization may not happen immediately. Bloggers should be patient and persistent in their efforts.

-

Competition: The blogosphere is vast, and standing out requires unique content and effective marketing strategies. Understanding the target audience and delivering content that resonates is essential.

-

Adapting to Algorithm Changes: Platforms like Google frequently update their algorithms, impacting how content is ranked and discovered. Bloggers must stay informed and adapt their strategies accordingly.

External References:

- Blogging MasterClass – DigitalSMN

- How to Make Money Blogging – ProBlogger

- Monetize Your Blog: 11 Ways to Successfully Turn Your Blog Into a Business – RyRob

- The Ultimate Guide to Making Money with AdSense – ShoutMeLoud

In conclusion, blogging for ad revenue represents a dynamic and accessible path to passive income. Through strategic content creation, niche development, and effective monetization strategies, bloggers can transform their platforms into profitable ventures. The flexibility, scalability, and global reach of blogging make it an attractive option for individuals seeking to leverage their passion or expertise into a sustainable source of income. While challenges exist, the potential rewards of turning content into cash through blogging make it a compelling choice for those willing to invest time, creativity, and perseverance in their digital endeavors.

Read Our Product Review Here

09. Automated Stock Trading: Letting Algorithms Work for You

In the ever-evolving landscape of passive income ideas, automated stock trading emerges as a sophisticated and tech-driven strategy for individuals seeking to build wealth with minimal hands-on involvement. Also known as algorithmic or algo trading, this approach leverages advanced computer algorithms to execute trades on behalf of investors. The allure lies in the potential to capitalize on market opportunities, optimize trading strategies, and, ultimately, generate passive income through the power of automation.

Understanding Automated Stock Trading:

-

Algorithmic Trading Basics: Automated stock trading relies on algorithms, sets of predefined rules and criteria, to execute trades. These algorithms analyze market data, identify patterns, and make buy or sell decisions based on predetermined parameters.

-

Minimizing Emotional Influence: One of the primary advantages of automated trading is the elimination of emotional decision-making. Algorithms operate based on logic and data, removing the impact of fear, greed, or other emotional factors that can affect manual trading.

Key Components of Automated Stock Trading:

-

Strategy Development: Traders or investors design algorithms by defining the criteria for entering or exiting trades. Strategies can range from simple moving average crossovers to complex quantitative models.

-

Backtesting: Before deploying an algorithm in real-time, it undergoes backtesting. This involves applying the algorithm to historical market data to assess its performance and refine its parameters.

Sources of Passive Income in Automated Stock Trading:

-

Dividend Stocks: Automated trading systems can be programmed to identify and invest in dividend-paying stocks. Dividend income becomes a source of passive earnings for investors.

-

Capitalizing on Market Trends: Algorithms excel at identifying and capitalizing on market trends. By automating the process, traders can benefit from price movements without constant monitoring.

Challenges and Considerations:

-

Technical Complexity: Developing effective algorithms requires a deep understanding of financial markets, programming skills, and continuous refinement to adapt to changing conditions.

-

Dependency on Technology: Relying on automated systems means vulnerability to technical glitches or system failures. Traders must have contingency plans in place.

External References:

- Introduction to Algorithmic Trading – Investopedia

- The Pros and Cons of Automated Trading Systems – The Balance

- How to Build an Algorithmic Trading System – Investopedia

Automated stock trading stands at the intersection of finance and technology, offering investors a powerful tool to generate passive income. By harnessing the capabilities of algorithms, individuals can navigate the complexities of financial markets with precision and efficiency. While challenges exist, the potential benefits, including minimized emotional influence, efficient execution, and the ability to capitalize on market trends, make automated stock trading an intriguing option for those seeking to optimize their passive income strategies in the ever-dynamic world of finance.

10. Royalties from Intellectual Property: Passive Rewards for Creators

In the realm of passive income ideas, deriving earnings from intellectual property stands out as a rewarding avenue for creators and innovators. Whether you’re an author, musician, inventor, or artist, your creative endeavors can become perpetual streams of income through royalties. This sophisticated yet accessible strategy allows you to monetize your intellectual capital, ensuring that your creations continue to generate revenue long after the initial effort.

Understanding Intellectual Property Royalties:

-

Types of Intellectual Property: Intellectual property encompasses various forms, including copyrights for literary and artistic works, patents for inventions, trademarks for brand recognition, and more. Each type offers unique opportunities for generating royalties.

-

The Concept of Royalties: Royalties represent payments made to the owner of intellectual property for the use or exploitation of their creations. This compensation structure allows creators to profit from their work without ongoing direct involvement.

Passive Income Through Licensing:

-

Licensing Artwork: Visual artists can license their artwork for use in various products, from apparel to home decor. Each time the art is used, the artist receives a royalty.

-

Patent Licensing: Inventors can license their patented inventions to companies for manufacturing and distribution, earning royalties based on sales.

Benefits of Intellectual Property Royalties:

-

Scalability: Intellectual property royalties offer scalability, allowing creators to profit from their work on a large scale without significant additional effort.

-

Diversification of Income: Creators can diversify their income streams by licensing their work to multiple platforms or companies, reducing dependency on a single source.

Challenges and Considerations:

-

Protection of Intellectual Property: Creators must take steps to protect their intellectual property through copyright, trademark, or patent registration to ensure they receive proper compensation.

-

Market Changes: Changes in market trends or technology can impact the demand for certain types of intellectual property, requiring creators to adapt and explore new opportunities.

External References:

- Understanding Intellectual Property – World Intellectual Property Organization (WIPO)

- How to License Your Artwork – The Abundant Artist

- A Guide to Music Royalties – Songtrust

Earning royalties from intellectual property represents a symbiotic relationship between creators and the ongoing value of their work. As technological advancements continue to shape the way we consume content, the opportunities for passive income from intellectual property are expanding. By navigating the world of copyright, patents, and trademarks, creators can turn their passion into a sustainable and lucrative venture, making intellectual property royalties a compelling and enduring option in the realm of passive income.

Conclusion: Crafting Your Passive Income Portfolio for 2024 and Beyond

In the evolving landscape of financial independence, the exploration of passive income ideas is pivotal for individuals seeking to secure their economic future. As we delve into the concluding chapter, it’s imperative to reflect on the diverse array of opportunities discussed and consider how each avenue contributes to the creation of a robust and diversified passive income portfolio.

Understanding the Power of Diversity:

Crafting your passive income portfolio involves a careful balance between various streams, ensuring resilience against market fluctuations and changes in consumer behavior. The top 10 passive income ideas explored in this guide offer a mix of investment, creativity, and entrepreneurship, allowing individuals to tailor their approach based on personal interests, risk tolerance, and financial goals.

Building on Reliable Foundations:

-

Real Estate and Dividend Investing: These time-tested strategies provide a solid foundation for a passive income portfolio. Real estate offers stability through property appreciation and rental income, while dividend investing allows you to grow wealth through consistent returns from well-established companies.

-

Exploring the Digital Landscape: Embracing the digital era, opportunities like affiliate marketing, creating and selling online courses, and blogging with ad revenue present scalable options for those with an online presence. The power of the internet allows individuals to reach global audiences, turning content and knowledge into revenue-generating assets.

Harnessing Financial Innovations:

-

Peer-to-Peer Lending and Automated Stock Trading: Engaging in peer-to-peer lending and automated stock trading leverages financial technologies to generate passive returns. These approaches minimize direct involvement, relying on algorithms and lending platforms to manage investments effectively.

-

Unlocking the Potential of Intellectual Property: The creation and licensing of intellectual property, from books to inventions, provide an enduring source of royalties. Creators can capitalize on their skills and innovations, turning one-time efforts into perpetual income streams.

Strategic Implementation and Continuous Adaptation:

Crafting a passive income portfolio is not a one-size-fits-all endeavor. It requires thoughtful consideration of personal strengths, interests, and financial objectives. Regularly assessing the performance of each income stream and staying informed about market trends ensures a dynamic and responsive portfolio that stands the test of time.

Embracing the Journey Beyond 2024:

As we step into the future, the landscape of passive income will continue to evolve. Emerging technologies, changing consumer behaviors, and global economic shifts will introduce new opportunities and challenges. Individuals committed to financial independence must remain agile, continually exploring innovative passive income ideas and adjusting their portfolios accordingly.

External References:

- Diversify Your Income: The Benefits of Passive Income – NerdWallet

- Passive Income Ideas for 2024 – Forbes Advisor

- The Importance of Diversification – Investopedia

In conclusion, the pursuit of passive income is a journey that requires strategic planning, adaptability, and a commitment to continuous learning. By carefully selecting and nurturing various income streams, individuals can craft a diversified portfolio that not only sustains them in the present but also positions them for financial success in the years to come. As you embark on this journey, may your passive income endeavors be both fulfilling and prosperous.

To know more about such strategies related to earning passive income, refer to our STRATEGIES page.